2025 has become a big year for the Sui blockchain. Once known as a promising newcomer, Sui evolved into one of the fastest-growing ecosystems in crypto, with over 150 successful DeFi projects launched this year. Sui TVL in DeFi increased threefold in just a few months, reaching the $2 billion mark, and experts predict $4-6 billion by Q1 2026.

Sui’s fast ecosystem growth is fueled by major network upgrades, a new consensus for higher throughput, and cross-chain integrations. Protocols like Momentum (CLMM), Magma Finance (DEX), Nemo (lending), and Zap by Turbos have already established themselves as key players, while liquid staking solutions from Haedal and upgrades from Cetus have further strengthened the chain. Sui is now positioning itself as a true leader in the DeFi race, not just a competitor with Ethereum, Solana or BNB Chain.

Lessons from Hyperliquid and Aster

The main thing that can drive TVL and blockchain ecosystem growth can be a well-timed, community-backed DEX. Hyperliquid raised headlines earlier this year by attracting more than $18 million in its presale round, quickly becoming one of the largest DEX launches on any blockchain in 2025. Within weeks of launch, Hyperliquid daily trading volume hit $500 million.

Aster followed a similar trajectory, securing over $12 million from early backers and positioning itself as a liquidity hub for cross-chain swaps. Both cases show a clear trend: native trading hubs create stable liquidity consolidation and push the blockchains they are built on. Ethereum had Uniswap, Solana had Jupiter, and now Sui is preparing for its own native DEX moment, SuiDEX.

Why Sui Needs a Native DEX

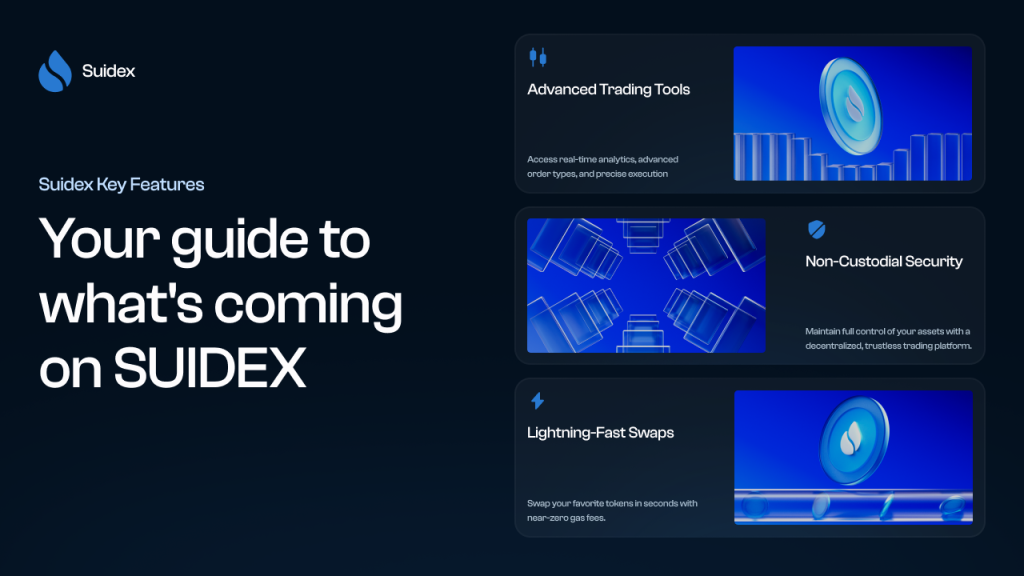

SuiDEX, powered by the Sui blockchain, will enable trading of Sui-based tokens directly on-chain, keeping liquidity within the ecosystem. With new liquidity pools, native staking and yield farming options, SuiDEX will boost the entire DeFi sector and keep value inside the Sui blockchain.

SuiDEX can become a trading hub for Sui traders with fast execution, optimized routing, and low fees. For investors, it opens access to advanced liquidity pools, staking, and farming modules that can generate consistent returns while supporting the ecosystem’s growth.

SuiDEX will not only provide a platform for token swaps but also a full set of advanced trading instruments:

- Initial staking module that will reward early token holders and give access to sustainable yield pools;

- Incentivized liquidity programs that will attract liquidity providers and give stable ecosystem growth for whole Sui ecosystem;

- Cross-chain swap support to allow traders seamless movement across blockchains without high gas fees;

- A governance model with DAO options that will allow SuiDEX token holders to vote on new pools, upgrades, trading pairs and platform further changes;

The SuiDEX team has already announced that the mainnet launch will be in Q4 this year, and investors will be able to use both token swaps and staking features even before the TGE.

SuiDEX Early Benefits for Investors

The SuiDEX is already attracting attention as one of the most significant fundraising events in the Sui ecosystem. While the team is focused on ecosystem development and strategic partnerships, early investors will be able to get exclusive benefits like premium liquidity pools and access to limited trading pairs, as well as early use of swap functionality and staking modules.

By positioning themselves at this stage, investors are not only part of the launch but also part of building the foundation for Sui’s decentralized trading future. With DAO voting and governance rights, early adopters will also help shape the direction of SuiDEX itself, making them long-term stakeholders in its growth.

SuiDEX Roadmap: October – December 2025

The SuiDEX team is preparing several milestones to be reached by Q4 2025, while the team is focused right now on strategic partnerships with key DeFi platforms to create a stable ecosystem for Sui traders.

- SuiDEX mainnet launch with staking options, initial token swaps, and liquidity pools.

- Release of the initial staking module with competitive rewards.

- Deployment of cross-chain swap support to integrate external assets.

The SuiDEX Token Generation Event and listing on major aggregators is planned for Q1 2026.

Market Situation and Predictions for Sui

Sui’s total value locked (TVL) in DeFi hit the 2 billion milestone in 2025, and analysts estimate that by early 2026, it may reach 4 billion. The chain’s capacity to handle quick transactions at low costs and growing institutional interest in Sui-based initiatives are the main drivers of this expansion.

Market experts also forecast that SUI’s price could see significant upward momentum if the current ecosystem growth continues. Projects like SuiDEX are positioned to become crucial building pieces for traders and investors looking for early exposure to this growing ecosystem, and Sui has the potential to become a dominant force in the DeFi industry.

About

SuiDEX is a Sui native DEX that offers improved features such advanced liquidity pools, quick token exchanges, and staking options. Its architecture is in line with the demands of the contemporary DeFi market, where low fees, scalability, and security are essential for sustained adoption.

With new projects, growing TVL, and growing institutional interest, the Sui blockchain is growing, and SuiDEX is well-positioned to help support that expansion. The objective is to fortify the entire ecosystem and assist Sui in becoming one of the top DeFi networks in the upcoming years by providing the infrastructure required for trade, governance, and liquidity.